Who is Charles Dow? He is an American journalist who co-founded the Dow Jones Index with Edward Jones Dow also founded the Wall Street Journal, which became one of the most respected financial publications in the world He also invented the Dow Jones Industrial Average as part of his research into market movements He also …

Dow theory of technical analysis

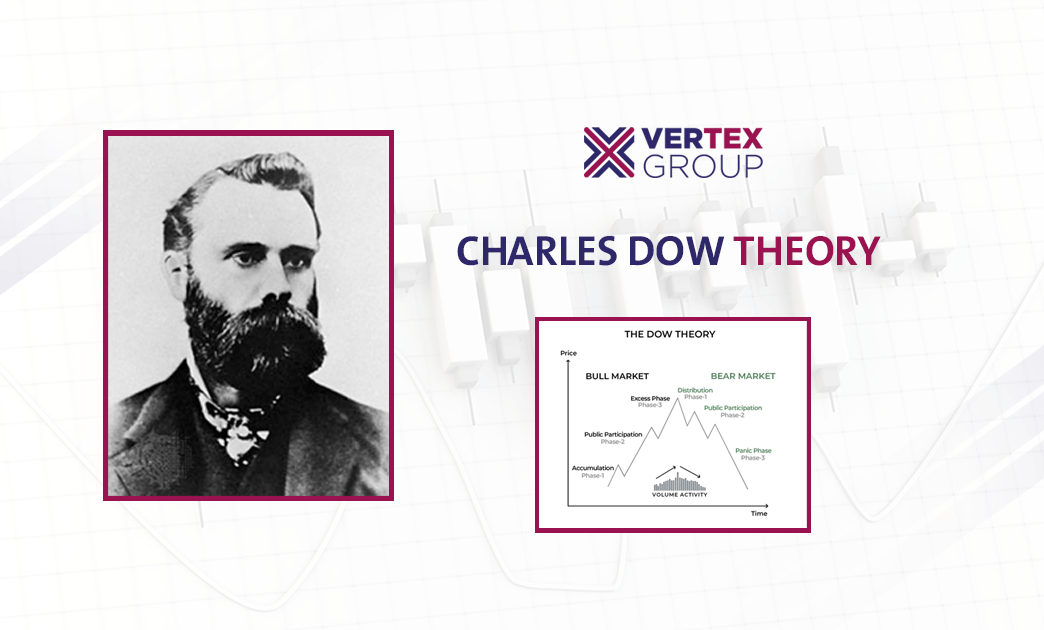

Who is Charles Dow?

He is an American journalist who co-founded the Dow Jones Index with Edward Jones

Dow also founded the Wall Street Journal, which became one of the most respected financial publications in the world

He also invented the Dow Jones Industrial Average as part of his research into market movements

He also developed a series of principles for understanding and analyzing market behavior that later became known as the Dow Theory

What is Dow Theory?

The Dow Theory is the first building block that was laid in the edifice of technical analysis, from which other theories and analytical approaches were derived. During this article, we will try to shed light on this theory and the foundations on which it is based and how we can benefit from it in knowing the direction of the markets.

Dow never wrote his ideas down as a specific theory or referred to them as such. Rather, it was a series of editorials that Dow published in the Wall Street Journal, which he founded. After his death, other editors, such as William Hamilton, refined these ideas and used his editorials to compile what is now known as Dow Theory.

As with any theory, the following principles are not infallible and open to interpretation.

Basic principles of the theory

Price action includes everything

Types of market trends

The three stages of the market cycle

Correlation between markets

Trading volume and its relationship to market direction

Trends are valid until a reversal is confirmed

Price action includes everything

The market reflects everything (price movement includes everything)

Dow believes that the market decides everything, which means that all available information is already reflected in the price.

For example, if a company is widely expected to achieve positive improved earnings, the market will reflect this before it happens. Demand for their shares will increase before the report is released, and then the price may not change much after the expected positive report is finally released.

In some cases, Dow notes, a company may see its stock price decline after good news because it was not as good as expected.

This principle is still believed by many traders and investors to be valid, especially by those who use technical analysis extensively. However, those who prefer fundamental analysis disagree and believe that market cap does not reflect the intrinsic value of a stock.

Types of market trends

Some people say that Dow’s work is what generated the concept of market trend, which is now considered a staple of the financial world. Dow Theory says that there are three main types of market trends:

- Primary trend – lasting from months to many years, this is the main market movement.

- Secondary trend – lasts from weeks to a few months.

- Third trend – tends to die in less than a week or no more than ten days. In some cases, it may last for only a few hours or a day.

By studying these different trends, investors can find opportunities. While the primary trend is key to consider, favorable opportunities tend to arise when secondary trends appear to contradict the primary trend. For example, if you believe a currency has a positive primary trend, but is experiencing a negative secondary trend, there may be an opportunity to buy it at a lower price. And profit once its value increases. The problem now, as then, is to recognize what type of trend you are observing, and this is where deeper technical analysis comes in. Today, investors and traders use a wide range of analytical tools to help them understand what type of trend they are looking for

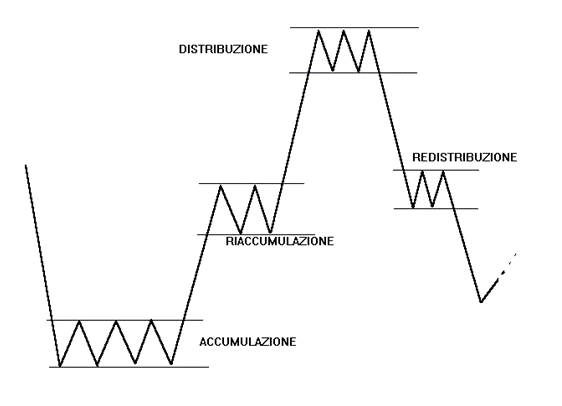

The three stages of the market cycle

Dow demonstrated that long-term primary trends have three phases. For example, in a bull market, the phases would be:

- Aggregation – After the previous bear market, asset valuation remains low as market sentiment is mostly negative. Smart traders and market makers start accumulating during this period, before a significant price increase occurs.

- Public Participation – The broader market now recognizes the opportunity that savvy traders have already noticed, and the public becomes increasingly active in buying. During this stage, prices tend to increase rapidly.

- Distribution – In the third stage, the public continues to speculate, but the trend is coming to an end. Market makers begin by unwinding their positions, that is, by selling to those who have not yet realized that the trend is about to reverse.

In a bear market, the phases will be reversed

Correlation between markets

Dow believes that fundamental trends shown on one market index should be confirmed by trends shown on another market index. At the time, this mainly concerned the Dow Jones Transportation Average and the Dow Jones Industrial Average.

At that time, the transportation market (mainly railways) was largely linked to industrial activity. This makes sense: to produce more goods, increased railway activity was first needed to provide the necessary raw materials.

As such, there was a clear link between the manufacturing industry and the transportation market. If one is healthy, the other likely will be as well. However, this principle of association does not quite hold up today because many goods are digital and do not require physical delivery.

Trading volume and its relationship to market direction

Size matters

As many investors do now, the Dow believes in volume as a crucial secondary indicator, meaning that a strong trend must be coupled with high trading volume. The higher the volume, the more likely the movement will reflect the true direction of the market. When trading volume is low, price action may not represent the true market trend.

Trends are valid until a reversal is confirmed

Dow believes that if the market is trending, it will continue to trend. So, for example, if a company’s stock starts trending upward after positive news, it will continue to do so until a definite reversal appears.

For this reason, Dow believes that reversals should be treated with suspicion until they are confirmed as a new fundamental trend. Of course, it is not easy to distinguish between a secondary trend and the beginning of a new primary trend, and traders often encounter misleading reversals that end up being secondary trends.

Concluding thoughts

Some critics argue that Dow Theory is outdated, especially with regard to the principle of correlation between indicators (which states that one indicator or average must support another). However, most investors consider Dow Theory relevant today. Not only because it is about identifying financial opportunities, but also because it will explain market trends