Investment concept It is the investment of money with the aim of achieving return, income or profit Investment also means giving away money that you own for a certain period of time with the aim of providing a reasonable return in exchange for bearing the element of risk represented by the possibility that this return …

Investment concept

It is the investment of money with the aim of achieving return, income or profit

Investment also means giving away money that you own for a certain period of time with the aim of providing a reasonable return in exchange for bearing the element of risk represented by the possibility that this return will not be achieved.

Some believe that investment means sacrificing a current benefit that can be achieved from satisfying current consumption in order to obtain a future benefit that can be obtained from greater future consumption, by abandoning current consumption in order to invest it temporarily in order to obtain a larger amount than it was possible to obtain. At present, it is possible to consume a field larger than the current one

Investors’ goal of investing

An investor buys assets based on expectations that they either:

Its value increases over time.

Or it will provide a new source of income.

Or it achieves both things together, meaning that its value increases over time, and provides a new source of income.

The importance of investment

Investment has great importance for the individual and society, and this is evident through the following:

It helps protect capital from inflation

Benefiting from money by making profits that develop it.

Obtaining an additional source of income for the investor

Increase the value of national income

Increase the rate of economic growth

Providing many job opportunities and eliminating a large percentage of unemployment

Diversify investment as a means of managing risk

Diversify investment as a means of managing risk

Asset allocation is the selection of a different group of investment assets in the investor’s portfolio, such as stocks, commodities, real estate, etc., that differ in their risk levels. The goal is to acquire high-risk assets that provide high returns, and low-risk assets that help stabilize the investment portfolio in the event that high-risk assets achieve returns less than expected. Diversification is adding an element of diversity in investments to the investment portfolio. For example, an investor can diversify his investment portfolio by investing in a number of companies in different industries, instead of investing in one or two companies, or one or two sectors. It is also possible to diversify by investing in companies of different sizes, instead of focusing the investment portfolio on shares of leading companies or shares of small companies. It is also possible to diversify by purchasing several types of digital currencies instead of focusing on only one currency.

Return and risk

In financial markets and business, the concepts of profit and loss are compared with two terms: return and risk, which means that investors making their investments entail an expected return and a potential risk. In other words, the terms investment, return and risk are intertwined. Wherever there is investment, there is return and risk.

The investor aims in making his investments to achieve high returns, and to reduce the costs or risks associated with these investments to the least amount possible

The return on investment is the return that the investor expects to receive in the future in exchange for the money he pays to acquire the investment instrument (the return represents the reward)

Risk arises as a result of the uncertainty surrounding the expected return from an investment

Because the return is linked to future cash flows, and these flows are linked to factors beyond the investor’s control, the return may or may not be achieved.

There is a direct relationship between return and risk. The greater the targeted return, the higher the degree of risk, and vice versa

The more ambitious the investor is to achieve a higher return, he must prepare himself to accept a higher degree of risk and vice versa

types risk

Systematic risks:

This type of risk is known as general risk and affects economic activity as a whole and its impact is not limited to a specific company or sector

Among them are economic risks such as recession, recession, decline in the purchasing power of the monetary unit (inflation), and changes in interest rates

Among them are political risks, meaning the possibility of important events occurring locally or globally, such as the possibility of fundamental changes being made in the political or economic system in the country, and these changes may have negative effects that are reflected in the results of the establishments’ activity, as an example of this is the assassination of US President John F. Kennedy, etc. This was followed by hysterical selling on the stock market that followed his assassination, after which the stock market returned to stability.

Unsystematic risks:

Mismanagement that may affect a particular company

Industry risks that may affect one sector rather than another

Risk return ratio

George Soros, one of the richest and most successful investors in the world, says, “It does not matter if your decision is right or wrong. Rather, what is more important is how much you gain if it is correct and how much you lose if it is wrong.”

This saying summarizes the basic foundation of the idea that the success of a trader or investor does not necessarily depend on how many times his analysis and vision of price movement and investment opportunities are correct, as much as it depends on the ratio of risk to return in his trading and investments. It is possible for the investor to be a winner in the end even though… His losing trades or investments are more profitable than profitable if he uses the risk to return ratio

There are types of ratio of risk to return: 1/2 – 1/3 – 1/4

Types of investors

Based on the relationship between return and risk, we can distinguish two types of investors:

The conservative investor is the one who is satisfied with obtaining a modest return on his investments in exchange for bearing the least possible amount of risk. This investor focuses on preserving the invested capital by avoiding the risks that may threaten it. This pattern often works for older investors who are nearing retirement and have limited opportunities to recoup any capital they may lose.

A speculative investor is one who moves towards high-risk, high-return areas of investment

Types of investment

Real investment is considered real investment when the investor has actual possession of a real asset such as real estate, goods, machinery…etc.

Financial investment is in financial assets whose possession results in a financial right that entitles its owner to claim a real asset and is usually in the form of an instrument or legal document such as securities (such as stocks and bonds) and financial derivatives (such as contracts for differences and futures contracts).

Types of investment in terms of time period

Long-term investment in investments that usually extend for more than three years, such as investment in industrial and agricultural projects or real estate investment

Medium-term investment in investments that extend over a period of time ranging from one to three years

Short-term investing is in investments that extend from a few days to less than a year

Classification of investments according to geographical criterion

Local investments include all investment opportunities available in the local market, regardless of the type of investment instrument used, whether financial or real assets

Foreign investments include all investment opportunities available in foreign markets, regardless of the type of investment instrument used, whether financial or real assets.

Scientific foundations and principles in making investment decisions

Determine the primary investment objective.

Collecting the information needed to make decisions

Evaluating the expected returns of the proposed investment opportunities. Every investor must evaluate these returns, when will I receive these returns, how many returns are in percentages or as a decimal number from the total working capital?

Choosing the optimal alternative or investment opportunity that is appropriate for the specific goals that the investor has previously identified

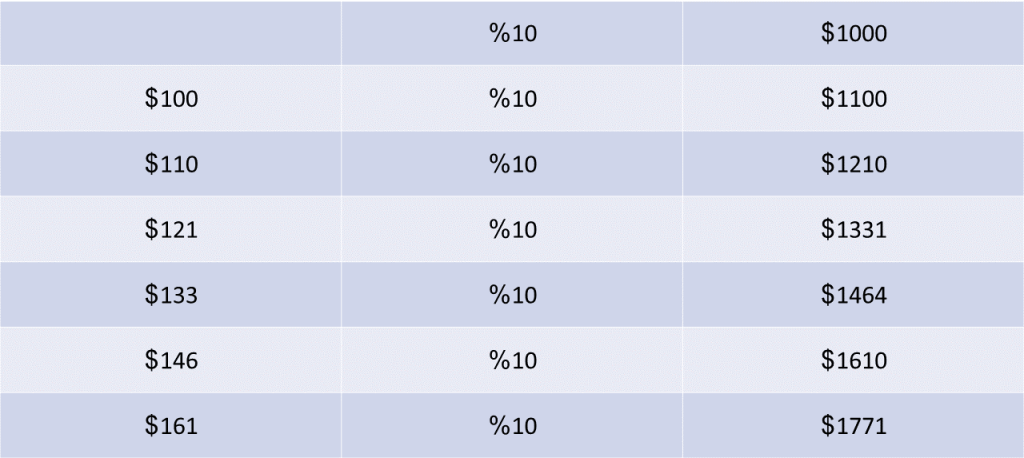

Compound or cumulative doubling of an investment through reinvestment of profits

When an individual saves money, time is his opponent, because inflation or the continuous rise in the values of goods and services reduces the purchasing power of his savings. But when he invests these savings, time turns into his friend because it allows the returns on his investments to increase. The returns multiply compounded or cumulatively when the individual reinvests the income or profits generated from his investments, and every time the individual reinvests the surplus returns, he achieves further compound growth of his invested capital. In this way, a small investment can multiply over time into a large investment.

Interest rates and investment

The interest rate is considered one of the most important determinants of the investment decision, whether the investor has the necessary capital or will resort to borrowing. The volume of investment has an inverse relationship with the interest rate, because the interest rate expresses the cost of obtaining funds for investment purposes. The higher the interest rate, the higher the direct cost of borrowing (if the investor were to borrow) and the opportunity cost (if the investor was to convert cash deposits into investment), which leads to a lower level of investment orientation, and vice versa.

Opportunity Cost

The opportunity cost can be defined as the value of the expected cost that could be lost from the existing project if another alternative was chosen, that is, the cost of the alternative that was chosen in exchange for the benefit that was lost from the first alternative, and what is the return that the second option will achieve.

The benefit of calculating opportunity cost: This theory is used in making administrative, investment, and accounting decisions, and it is also used to evaluate alternatives, but it does not appear in calculations or in records, but rather in reports and studies when planning to make a specific decision, and it is also used in personal life in making decisions. If there are several options, a sacrifice must be made and the best one must be chosen to achieve a higher benefit. We note that there must be a pure study and study of all the options from different aspects, and then the sacrifice is made and it is known whether the alternative option was better or not after application and implementation.

Examples of opportunity cost

The first example is a person who owns a store. Should he continue to operate it or rent it? If this person continues to operate it, his cost will be the amount of rent he would miss if he actually rented this store to someone else.

The second example is a person who has a plot of land worth 50,000 dinars, and he has several options to build a commercial project such as a gas station or build a residential complex or a restaurant to achieve a 15% increase in the value of the land. What does he choose? If this person hypothetically decided to build a residential complex, the cost of building the residential complex would be the opportunity cost of building a gas station instead of the residential complex. If the residential complex achieved a return less than the expected percentage above, this person would have lost the opportunity to build a gas station that would have had to benefit from its construction. If the residential complex achieves a higher return, the choice will be correct in achieving the return it specified.