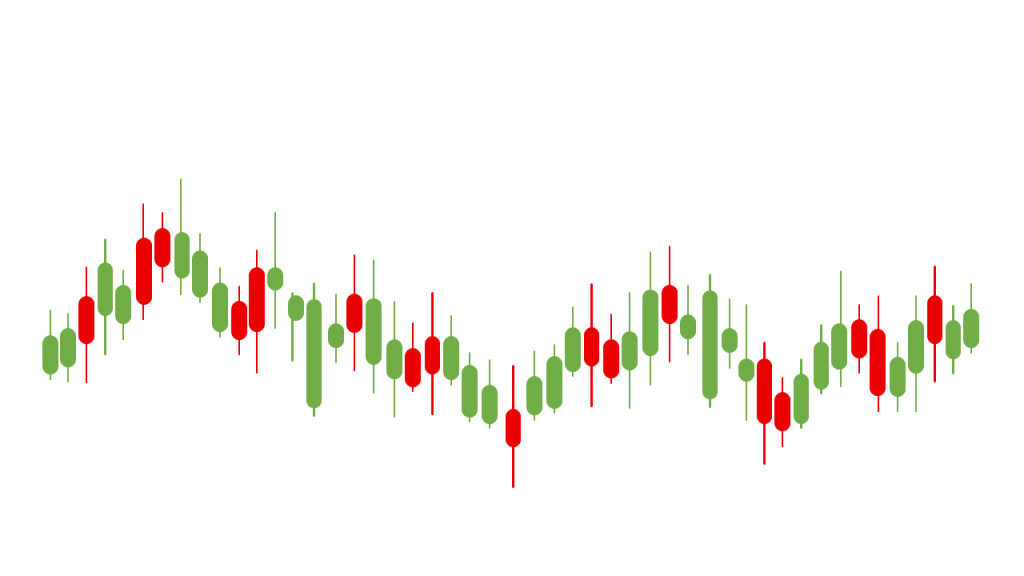

The price displayed on the price chart at any given time represents the general trend and sentiment of market participantsIf prices are rising, this means that buyers are in control, while in declining markets, this means that sellers are in control, and in sideways markets, there is no dominance of either party over the other.In …

price movement and price correction

The price displayed on the price chart at any given time represents the general trend and sentiment of market participants

If prices are rising, this means that buyers are in control, while in declining markets, this means that sellers are in control, and in sideways markets, there is no dominance of either party over the other.

In this article, we will learn about the prevailing trends of price movement and the meaning of each one of them, and we will learn about the most important characteristics of price movement, such as price correction and others.

As for the cases where the price is, it is either an uptrend, a downtrend, or a sideways movement

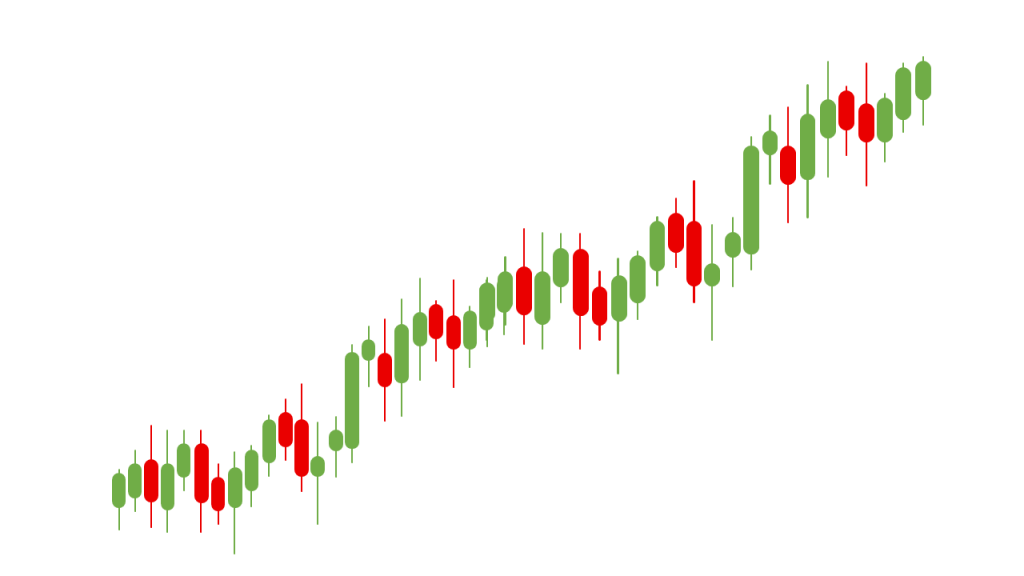

Uptrend or “bull market”

An upward trend in financial markets refers to an upward movement of prices over a sustained period of time. This trend is also called the bull market, and is characterized by a feeling of optimism and confidence because demand pressure exceeds supply pressure, and therefore it reflects rising prices.

An uptrend generally begins after a period of hesitation and uncertainty in the market before it begins to move higher

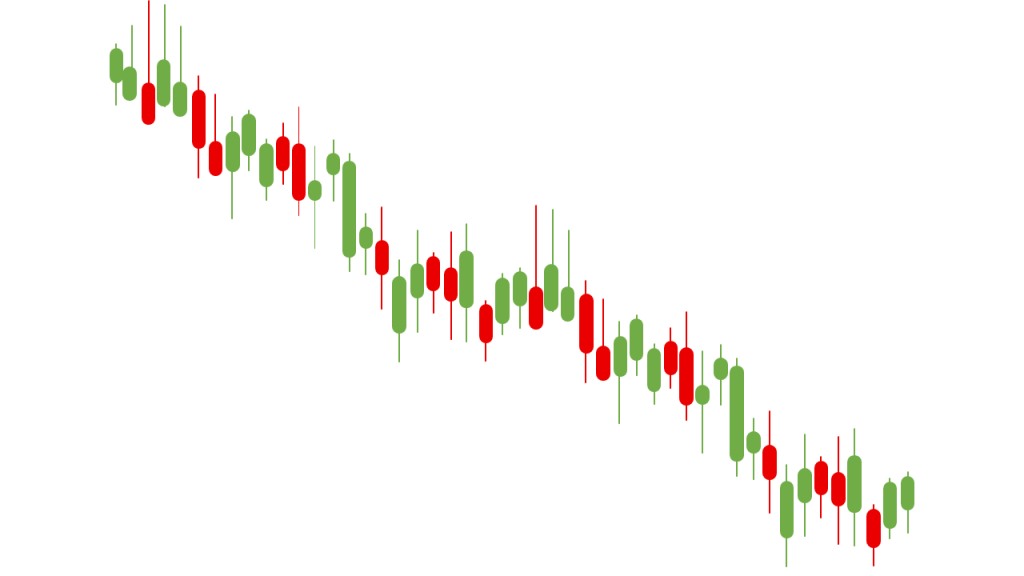

Downtrend or “bear market”

A downtrend or “bear market” refers to the moment when the price begins to decline in a sustainable manner. Pessimism and fear of losing money begin to spread in the financial markets. Here, investors begin

to exit the market as selling pressure exceeds buying pressure.

Sideways movement or directionless market

This occurs when the market is not defined as being in an uptrend or a downtrend, but rather the price of the financial asset oscillates in a narrow range up and down.

During the sideways market, large returns are not usually achieved, but rather traders rely on quick trades (scalping) to achieve small and fleeting returns on a frequent basis.

Characteristics of price movement (price movement is gradual and not continuous)

One of the things that you will realize immediately is that the nature of the movement of currency prices occurs gradually and not continuously, and this applies to the movement of currency prices as it applies to the movement of stock prices, commodities, and everything that is traded in the financial markets. What do we mean by that?

What we mean by this is that even if the price of a currency will rise by 100 points in 5 hours, for example, it will not rise hour after hour or minute after minute. Rather, its rise will be interspersed with many declines, but overall and the final result will rise.

Thus, the price movement continues to decline and rise hour after hour, but overall it rises until it reaches what we expected and may greatly exceed our expectations.

As you can see, it is more like a hesitant rise, which is the cause of headaches for traders

When you open a deal, you often find yourself a loser, then you become a winner, then you lose again, then suddenly you turn into a big winner..!!!

Therefore, many beginners feel terrified when the price begins to decline. For fear that the price will continue to decline, they may decide to sell at a loss and close the deal quickly so that their losses do not increase. Thus, the loss turns into a real loss because they finished and closed the deal. But the price may then return to rise and they become winners after they were losers. But after it was too late, they closed the deal with a loss. If they had been patient a little, their floating loss would have turned into a profit, and they would have been able to close the deal as winners instead of closing it as losers.

The whole issue depends on your confidence in your prediction. If you are confident of the soundness of your prediction, you will not fear anything if the price drops slightly because you are confident that it will return to the rise shortly.

It is like a game of finger-biting that will be won by the one who has the strength of nerves, psychological calm, and self-confidence…

Characteristics of price movement (price correction)

When you follow the movement of currency prices, you will often hear that “such and such a currency is making a corrective movement.”

This is one of the natures of price movement. What is meant by corrective movement?

It is the same gradual nature of the currency movement that we talked about, but often within a broader time frame.

For example: If the euro was destined to rise within seven days by 820 points, for example, it may rise in the following manner:

On the first day, 180 points.

On the second day, 150 points.

On the third day, 240 points.

On the fourth day, the price drops 120 points.

On the fifth day, the price drops 50 points.

On the sixth day, the price rises 200 points.

On the seventh day, it rose 220 points.

As you can see, the total amount that the Euro rose from the first day to the seventh day is equivalent to 820 points. It was on a daily rise except for the fourth and fifth days, during which the price decreased somewhat before it rose again later.

The price movement on the fourth and fifth days is called a price correction movement.

It is a movement that is in the opposite direction of the general direction of the price movement, and you can imagine it as a rest period during which the market takes its breath after it has moved strongly and in one direction for a period of time, after which the price continues moving in its direction again.

Of course, this rest period does not have to be on the fourth or fifth day, it may be at any time, and no one knows exactly when it may occur, but when the price moves in one direction and for a period of time and strongly, it becomes expected that a correction movement will occur in the price, and the longer the price continues By moving in its direction without stopping, the greater the possibility of a corrective movement occurring.