What is natural gas? Some people mistakenly perceive natural gas as a by-product of crude oil, such as gasoline, diesel, and other oil derivatives, but natural gas is not that. Rather, it is one of the alternative energy sources to oil from highly efficient fuels with low emissions that pollute the environment. The drilling technology …

Trading and investing natural gas

What is natural gas?

Some people mistakenly perceive natural gas as a by-product of crude oil, such as gasoline, diesel, and other oil derivatives, but natural gas is not that.

Rather, it is one of the alternative energy sources to oil from highly efficient fuels with low emissions that pollute the environment. The drilling technology used in the production of natural gas has witnessed remarkable progress in recent years, which has made it one of the main commodities that will be used to cover energy needs in the future.

The uses of natural gas include heating, electricity generation, and cooking. The electricity market is the main consumer of natural gas, and it is also used as fuel for ships, cars, trains, and others.

The importance of trading and investing in natural gas

When it comes to energy commodities, it is no secret that oil is number one in trading and investment and is the most widespread in the world.

However, this does not diminish the importance of natural gas, as it ranks second after oil and is considered the second largest

Energy commodities are traded and invested in, and it is considered a good choice for traders and investors looking for ways to diversify their portfolios

The largest exporters of liquefied gas in the world

Liquefied gas (is gas that is cooled until it turns into a liquid state that is easy to store and ship)

In 2022

- Qatar

- Australia

- United States

- Russia

- Malaysia

In 2023, the United States surprised everyone, as it surpassed Qatar and Australia to become the world’s largest exporter of liquefied natural gas, so the ranking became

- United States

- Australia

- Qatar

- Malaysia

- Russia

The price of natural gas and the factors affecting it

The price of natural gas is the value of gas agreed upon between buyers and sellers

The price of natural gas is affected by a number of factors, including:

- Supply and demand: The laws of supply and demand are considered one of the most important factors that affect the price of natural gas. When the demand for natural gas is greater than the available supply, this leads to an increase in prices. Conversely, when the supply is greater than the demand, this leads to a decrease in the prices

- Natural gas reserves: Many countries around the world have natural gas stores that can be used in the event of supply disruptions by storing gas. Governments hope to alleviate some of the problems associated with increasing prices in times of low production.

Of course, there is an inverse relationship between gas stocks and gas prices - Natural gas production: There is also an inverse relationship between gas production and gas prices

- Natural gas extraction and processing: Natural gas extraction and processing is a very expensive process. Any interruption in the extraction process will lead to a delay in natural gas production and thus lead to a decrease in gas supplies and an increase in prices. Natural gas processing operations are more expensive and any disruption Or a halt in this process would have a significant impact on gas prices

An example of this is the fire that broke out at the Freeport LNG terminal in Texas and led to its closure. This was in 2022 as a result of a methane gas leak from one of the gas shipping lines. This led to a decline in US gas exports and also disturbances in gas prices, and in return. The return of the station to full operation in 2023 contributed to America topping the list of oil exporting countries - Seasonal demand patterns and weather conditions: The demand for natural gas is also seasonal and related to changes in weather conditions. For example, during cold weather or in the winter, the demand for natural gas for heating purposes increases, thus causing prices to rise.

An example of this is the decline in demand for gas in Europe, with its reserves reaching historic levels. Agence France-Presse quoted an analyst at RBC Capital Markets, Biraj, as saying, “The mild winter and liquefied natural gas exports are at unprecedented levels from the United States and the sector’s demand.” The low residential and industrial levels led to a decline in European gas prices.” He also pointed out that “global warming reduces the demand for gas for heating.” - Politics and wars: Politics, wars, and conflicts may affect global markets in general, including natural gas prices.

An example of this is the Russian war on Ukraine and the accompanying rise in natural gas prices, as Ukraine accused Russia of waging a “gas war” against Europe and using gas as a political weapon, as Russia reduced gas supplies through the “Nord Stream 1” pipeline and it became operational. With less than a fifth of its normal capacity, and to find a solution, America intervened by increasing its gas exports to Europe to compensate for the shortfall in Russian supplies and to reduce Europe’s dependence on Russian gas. - Accidents and disasters: Catastrophic events that affect the extraction, processing, distribution and consumption of natural gas will have a direct impact on gas supply levels and demand rates. Operational disturbances directly lead to delaying and reducing gas supply levels and thus prices jump during the recovery period.

Fundamental analysis of natural gas

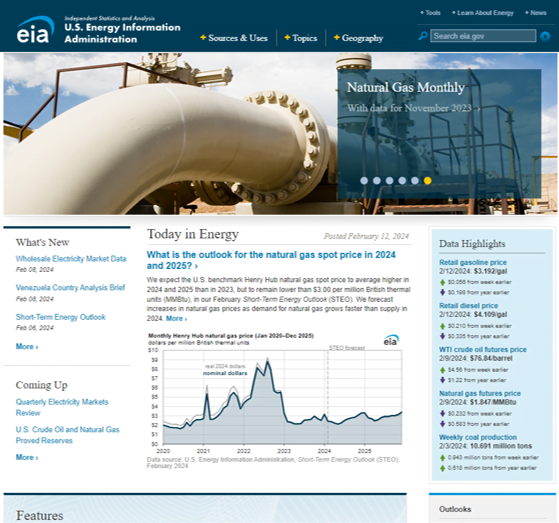

US Energy Information Administration (EIA) Energy Information Administration

It is a major agency of the United States Federal Statistical System responsible for collecting, analyzing, and disseminating information about energy. The EIA conducts a comprehensive data collection program covering all energy sources, uses, and energy flows. It performs analyzes and creates short- and long-term forecasts for domestic and international energy.

EIA publishes its data, analyses, reports, and services on its website and can be followed on its social media pages

We find the dates of the energy outlook report issued by the US Energy Information Administration in the economic calendar